[ad_1]

Asset manager 7RCC has formally submitted a spot Bitcoin exchange-traded fund (ETF) application focused on environmental, social, and governance (ESG) principles to the Securities and Exchange Commission (SEC).

As detailed in the proposal filed on December 18, the ETF is structured to appeal to ESG investors. In line with this commitment, the application will consist of 80% Bitcoin (BTC) and 20% carbon credit futures.

The Bitcoin component provides exposure to the cryptocurrency market while including carbon credit futures, reflecting a dedication to supporting environmentally responsible initiatives.

The 7RRC proposal adopts a balanced approach, aiming to appeal to investors seeking financial returns and a portfolio aligned with their ESG values.

If approved, the asset manager will create a novel investment opportunity under the ticker name BTCK, which will merge digital assets and sustainable finance.

However, the S-1 filing doesn’t address the ongoing debate about the preferred mechanism, “cash or in-kind,” for licensed participants to create and redeem shares of the Bitcoin ETF.

Currently, this matter is actively being discussed in meetings involving potential issuers, including prominent players like BlackRock and the SEC.

💥BLACKROCK MEETS WITH SEC 4 TIMES OVER ETF + “COUNTDOWN FOR BITCOIN ETF DECISION APPROACHING CRITICAL DEADLINE”🚀🚀🚀🚀🚀🚀🚀🚀🚀💥 pic.twitter.com/VyHZcQB6VG

— ISO 20022…. LET’S DO IT (@Rohitku24694375) December 17, 2023

Notably, 7RCC has chosen Gemini as the custodian for the ETF and is leveraging the financial platform Tidal to white-label its ETF.

The Gemini exchange was chosen as a custodian based on the application of the manager of 7RCC Global for an unusual futures Bitcoin and Carbon Credit ETF, which was submitted to the SEC yesterday

The ETF will be 80% BTC and 20% carbon credit futures $BTC #bitcoin pic.twitter.com/1e31QIPCEN

— Crypto 4 Light (@vladi4light) December 19, 2023

These decisions reflect 7RCC’s strategic approach to structuring and branding the ETF, showcasing adaptability to the evolving landscape of cryptocurrency investments.

In response to this development, Nate Geraci, the president of ETF Store, noted that the emergence of an ESG Bitcoin ETF was expected, stating it was “only a matter of time.”

New filing: 7RCC Spot Bitcoin & Carbon Credit Futures ETF…

Holds 80% bitcoin & 20% carbon credit futures.

Was only a matter of time before we got an “ESG” bitcoin ETF.

We’re gonna see all types of permutations on spot bitcoin ETFs. pic.twitter.com/yeIyEGaGyf

— Nate Geraci (@NateGeraci) December 18, 2023

Additionally, Geraci anticipated various iterations in the landscape of spot Bitcoin ETFs. This suggests that as the market evolves, different forms of Bitcoin ETFs, particularly those aligned with ESG principles, will likely emerge to meet investors’ diverse preferences and considerations.

The Rise of the ESG Market

In the submitted application, Rali Perduhova, co-founder and CEO of 7RCC Global, acknowledged the prevailing negative perceptions surrounding Bitcoin mining and its environmental impact.

He underscored the firm’s strategic commitment to catering specifically to institutional investors actively seeking environmental, social, and governance (ESG) considerations. The goal is to provide a solution with the coveted ESG endorsement.

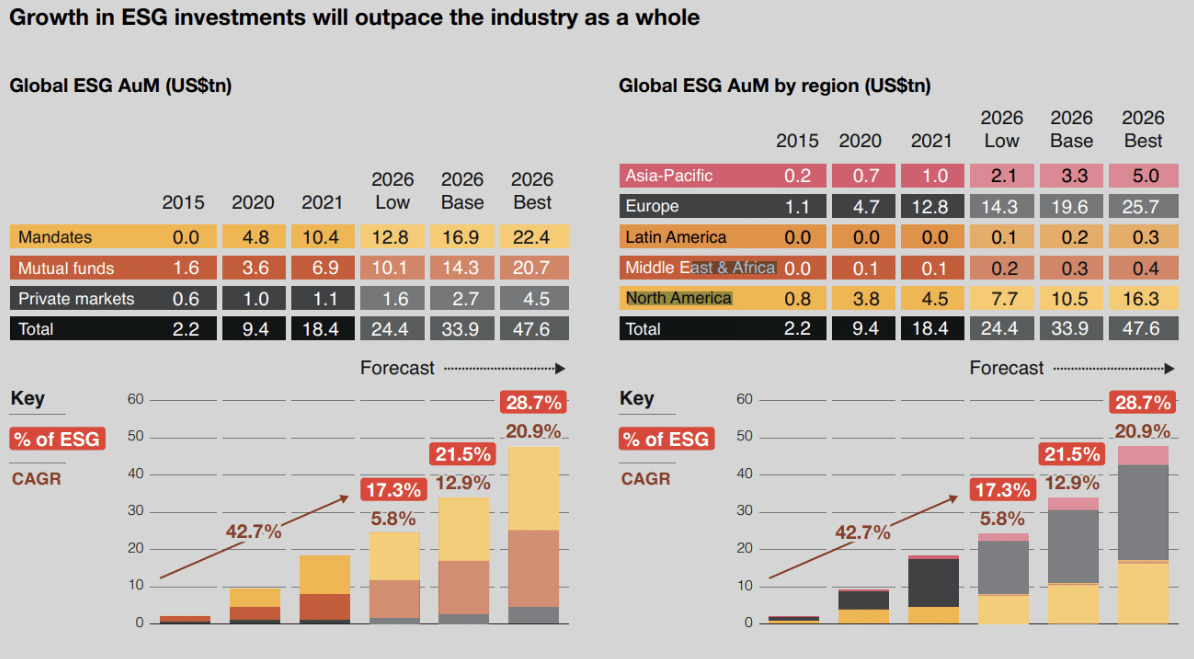

ESG has evolved into a prominent investment strategy, providing firms with the opportunity to adopt socially conscious practices. This involves focusing on assets that address critical issues such as climate change and diversity.

A noteworthy trend, highlighted in a November 2022 Harvard survey, indicates that 81% of US institutional investors plan to increase allocations to ESG products in the next two years. The survey projected that assets under management in ESG products could double to $10.5 trillion by 2026.

A substantial 60% of investors reported higher ESG investment performance yields compared to their non-ESG counterparts.

Additionally, over three-quarters of investors were willing to pay higher fees for ESG funds. Notably, despite potential higher compliance costs for asset managers, there is limited evidence of increased fees for retrofitted funds.

[ad_2]

Source link